Washington State Estate Tax 2025. The state of washington estate tax threshold amount for year 2025 is $2,193,000. By washington state business and real estate law lawyer per e.

Washington State Estate Tax Exemption 2025 Winny Kariotta, How to avoid washington state estate tax in 2025 if you leave behind more than $2.193 million when you die, your estate might owe washington state estate tax. The exemption amount is meant to be adjusted for inflation, but it has not changed since.

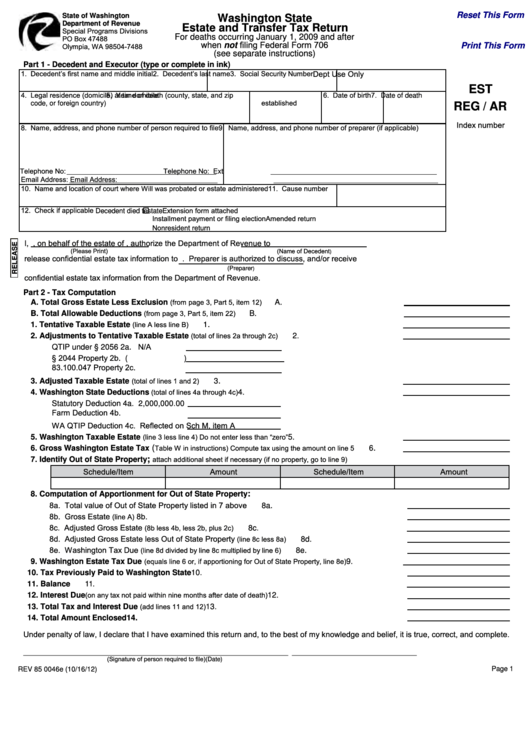

Fillable Washington State Estate And Transfer Tax Return Form Printable, This exemption amount has not increased. Before discussing what can be done, here are a few things to know about the state estate tax for washington residents:

How Much Did Property Taxes Go Up In 2025 Debor Eugenia, Federal and washington estate taxes for 2025. In washington state, the estate tax exemption has remained at $2.193 million per person since 2018.

Inheritance Tax Washington State 2025 Alisa Belicia, Wa state estate tax explained. Our team provides a cheat sheet for your 2025 federal & state estate, gift, and gst taxes, including information on exemptions and rates.

Washington State Estate And Transfer Tax Return Fillable Form, The current washington estate tax exemption is $2.193 million for deaths occurring in 2025. The washington estate tax on $3.8 million is still significant.

Washington State Estate and Inheritance Tax Your Answers Here Law, A chart that provides the key washington estate tax figures for 2025 and 2025, including the estate tax exemption amount and top rate. This means that if the total value of the deceased’s assets is below this amount,.

20182024 Form WA DoL TD420041 Fill Online, Printable, Fillable, The washington state estate tax exemption for 2025 remains at $2,193,000. But that’s less than a third of the tax an estate might pay in the absence of.

Avoid Washington State Estate Taxes for 2025 Moulton Law, So if a person’s estate is equal to less than $2.193 million, then it won’t be taxed by. In washington state, the estate tax exemption has remained at $2.193 million per person since 2018.

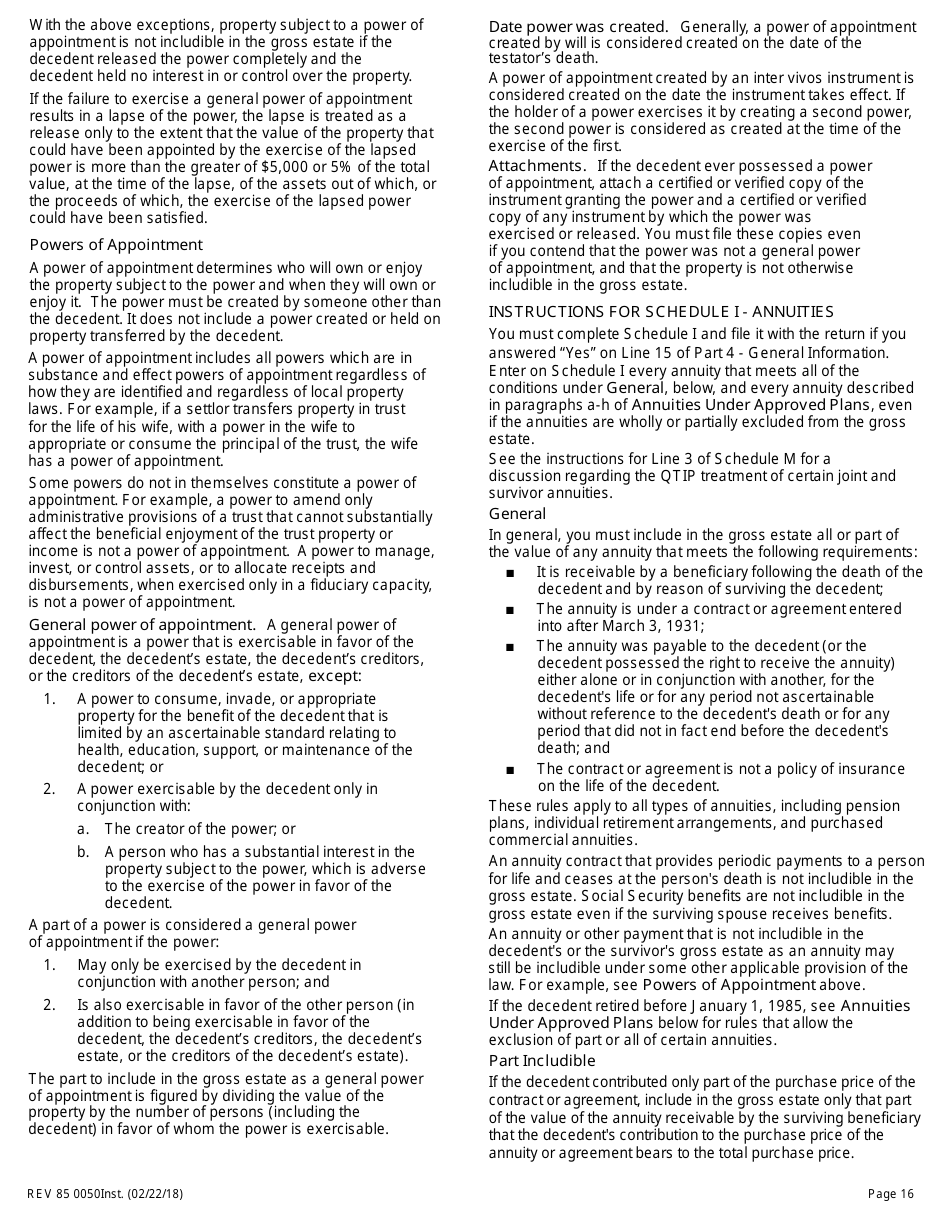

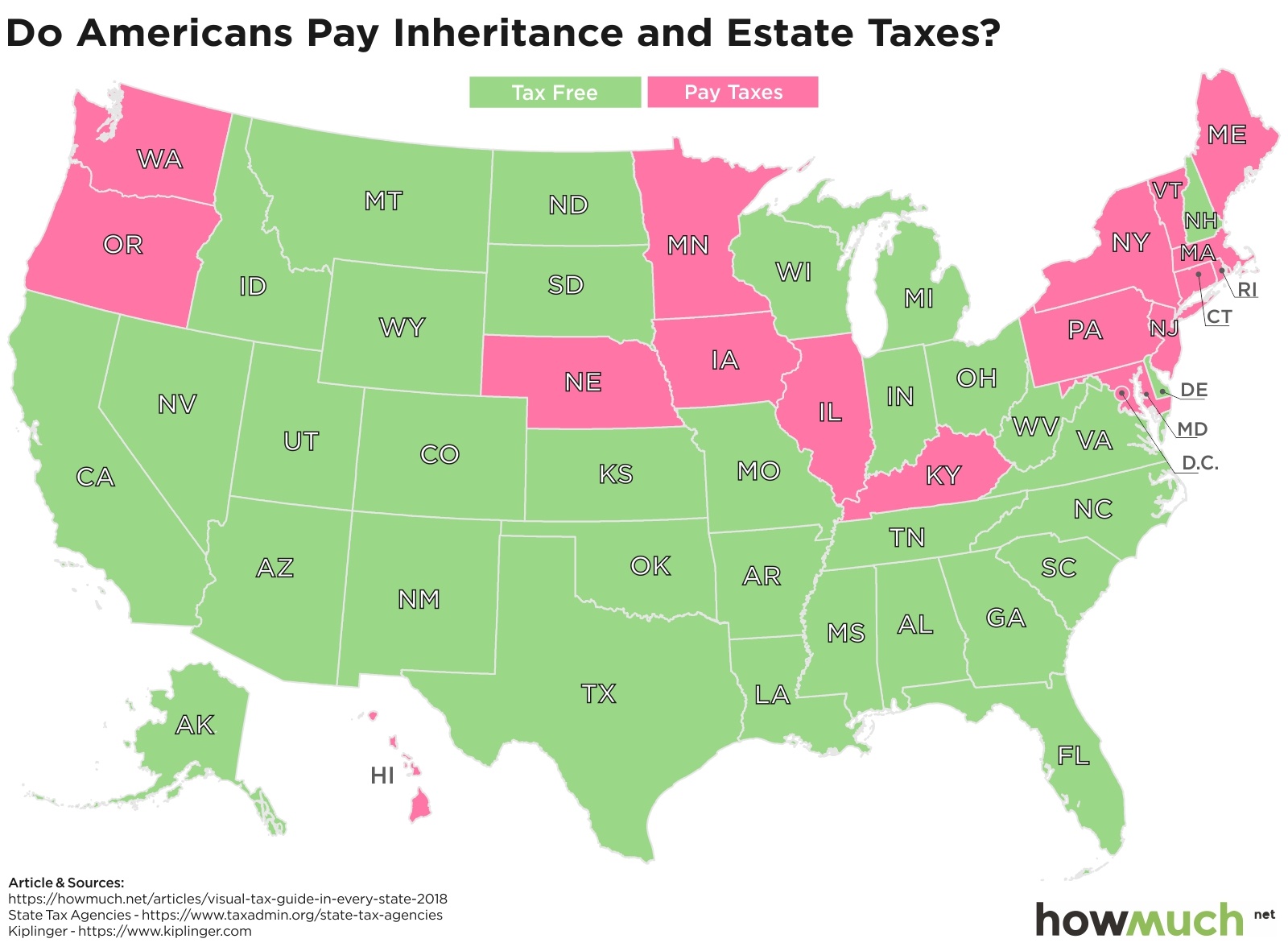

Download Instructions for Form REV85 0050 Washington State Estate and, But that’s less than a third of the tax an estate might pay in the absence of. Two states, connecticut and vermont, have flat estate taxes with a single tax rate.

Estate and Inheritance Taxes Urban Institute, In washington state, the estate tax exemption has remained at $2.193 million per person since 2018. Our team provides a cheat sheet for your 2025 federal & state estate, gift, and gst taxes, including information on exemptions and rates.