Federal Gifting Limit 2025. The proposal aims to decrease the federal deficit by roughly $3 trillion within the next decade. 2025 annual gift and estate tax exemption adjustments.

(that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married couples,.

This is known as the “gift tax exclusion amount.” spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

IRS Increases Gift and Estate Tax Thresholds for 2025, The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation. If you gift more than that, you’ll need to file a federal gift tax return when you complete your taxes in 2025.

401(k) Contribution Limits for 2025, 2025, and Prior Years, What came to be called. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

401k 2025 Contribution Limit Chart, The annual gift tax limit is $18,000 per person in 2025. Also for 2025, the irs allows a person to give away up to $13.61 million in assets or property over the course of their lifetime and/or as part of their estate.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The 2025 gift tax limit is $18,000. What is a gift tax and who is taxed?

IRS Gift Limits From Foreign Persons 2025, What is the gift tax rate for 2025? The biden administration has released its budget proposal for fiscal year 2025.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, Married couples can effectively double this amount by “splitting” their gifts, which allows them to collectively give up to $30,000 per recipient without consequences. The 2025 gift tax limit is $18,000.

annual gift tax exclusion 2025 irs Trina Stack, Single taxpayers 2025 official tax brackets. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

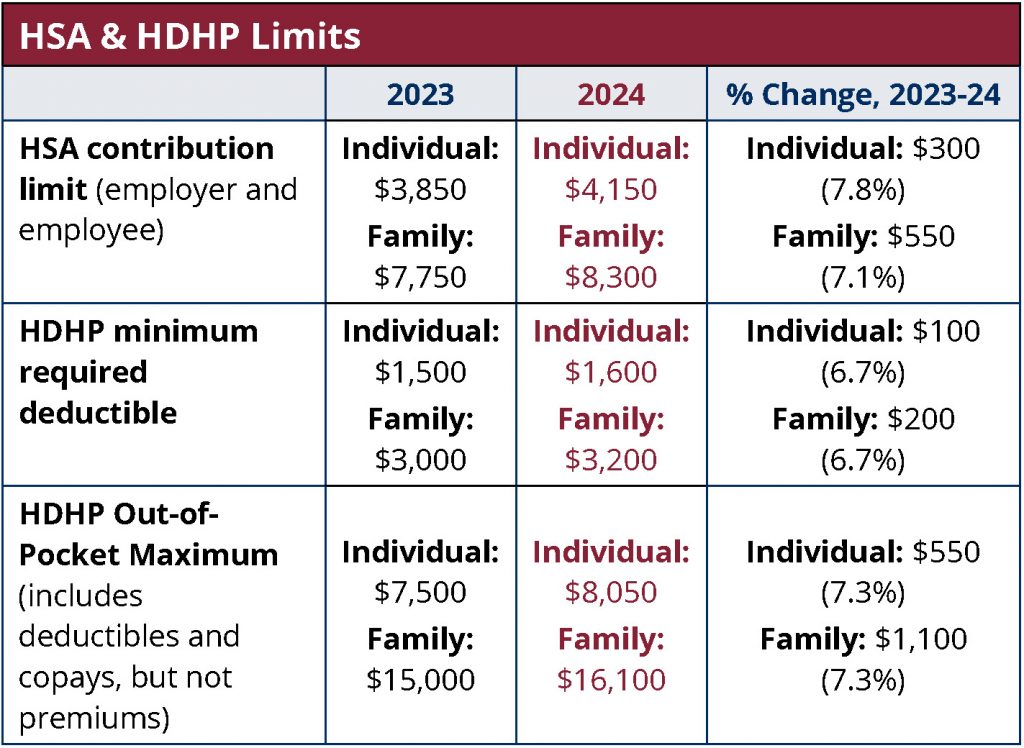

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, The internal revenue service recently announced that the federal estate and gift tax exemption amounts will be $13.61 million per individual for gifts and deaths occurring in 2025, increasing from $12.92 million in 2025. Do you pay taxes when you receive a gift?

2025 Estate and Gift Taxes Offit Kurman, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). Standard deductions are $14,600 for single filers, $29,200 for married couples filing jointly, and $20,800 for head of household filers.

The gift tax exemption limit has increased for 2025, allowing individuals to give up to $18,000 per person without incurring taxes.